Table of Contents

Upon creating of your account in Oojeema, the information you have provided in the registration form will be used as part of the company information. This includes the basic information about your company as well other information used in your forms and reports.

Company Logo #

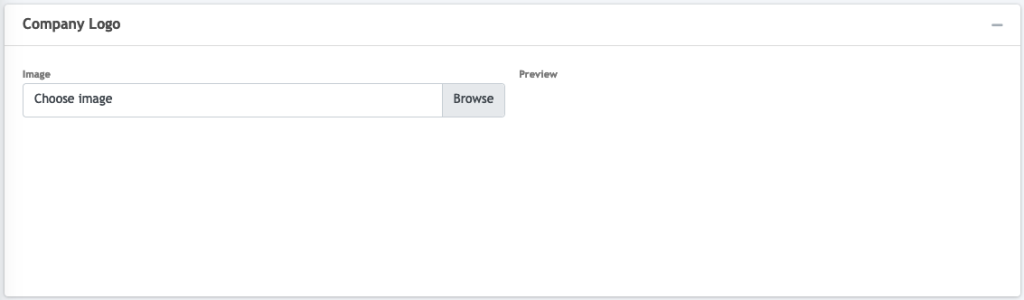

Basic Information #

- Enter the required fields marked with red asterisks.

- Select the Business Type. For Individual or non-corporations, you would be asked to fill-up the Taxpayer’s compete information.

- Select the appropriate BIR RDO code where your company is registered.

- Select the VAT registration type.

- Enable the “Use Sales Invoice for Services” to include service items in your sales invoices.

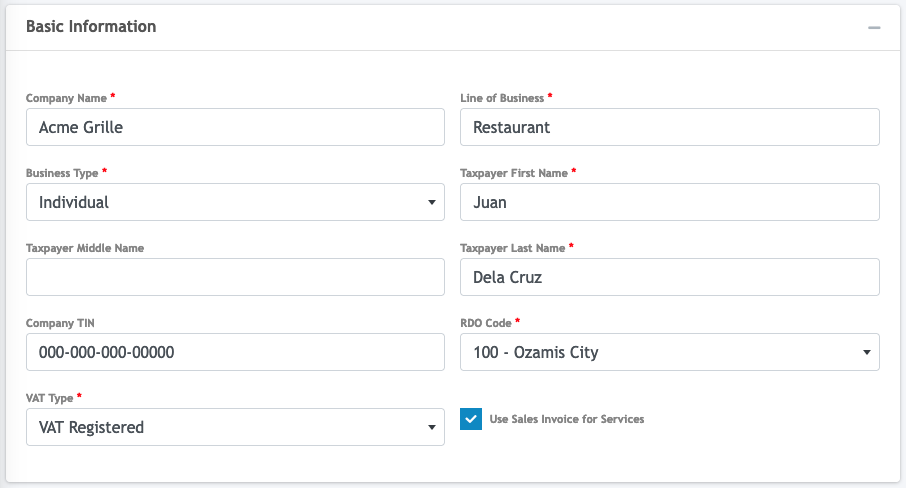

Contact Information #

- Enter the details of your company’s contact person.

- You can update your company’s address in this section.

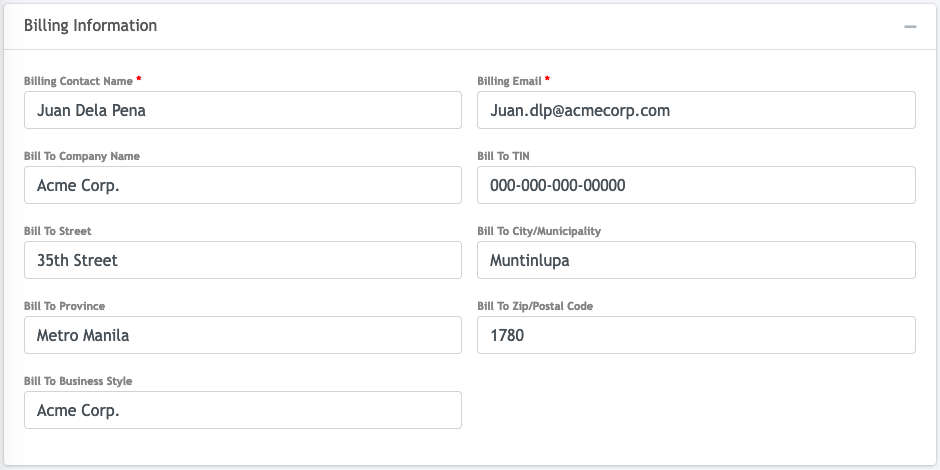

Billing Information #

The billing information by default, will contain the information of the user who created the account. Update this to the details of the person who will received billing notifications including the information where the official receipt will be issued to.

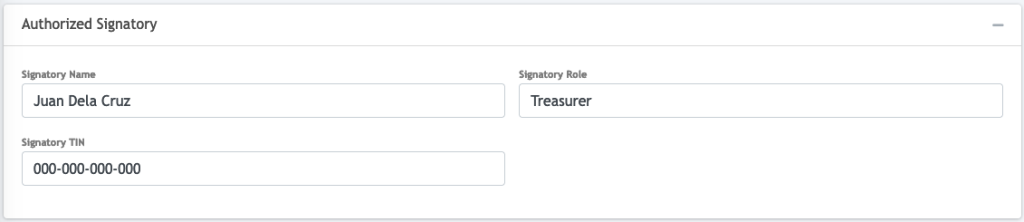

Authorized Signatory #

The information under the Authorized Signatory section is used to pre-fill the BIR forms that will be generated for submission to the BIR.

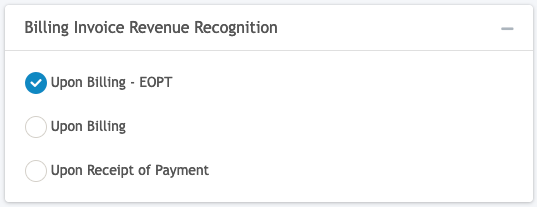

Billing Invoice Revenue Recognition #

There are 3 revenue recognition options to choose from:

- Upon BIlling – EOPT complies with the EOPT Law requiring VAT being recognized upon invoices of services.

- Upon Billing is the accrual method where income is recognized upon invoicing and VAT is recognized upon receipt of payment from the customer.

- Upon Receipt of Payment is the cash method where income and VAT is recognized upon receipt of payment from the customer.