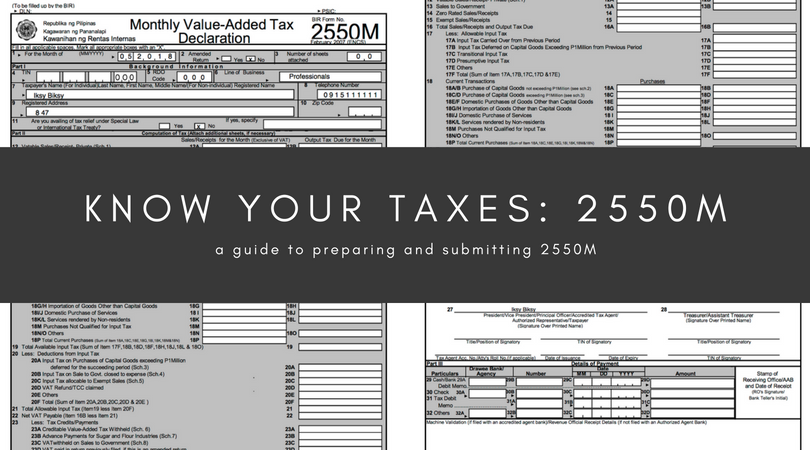

If you’re a VAT-registered business or a business required to register as a VAT payer, you should file for 2550M.

2550M must be filed and paid for not later than the 20th day of the following month for eBIR and for eFPS. However, for some groups, eFPS may be paid for until the 25th.

BIR usually moves the deadline to the next working day.

2550M may be filed via eBIR and EFPS.

For eBIR filing, you file online then may choose to pay via: #

- Authorized Agent Bank (AAB)

- GCash

- Online payment

- Authorized Municipal or City Treasurer

Note that the AAB depends on your location. For a full list of these banks, check this list.

For digital filing: #

Log on to https://efps.bir.gov.ph/

You may be asked to pay 25% of the total amount due, 20% per annum of the total amount due, and/or compromise penalty depending on the reasons for late filing.

Yes. For the rates, please refer to the question above.

- Proof of the payment and the return previously filed, for amended return.

- If applicable, the following should be attached:

- Duly issued Certificate of Creditable VAT Withheld at Source

- Duly approved Tax Debit Memo

- Duly approved Tax Compliance Certificate

- Authorization letter if the filed by the representative.

2550M for first 2months of the quarter. 2550Q for the quarter.

SAWT is not a required attachment to 2550M.

Yes. File it on the following month.

No. 2550Q is enough.

Write it in the field labeled 18M Purchases Not Qualified for Input Tax.

No. It’s required for 2550Q instead.

It’s better to amend 2550Q instead of 2550M. The former is designed to contain all corrections and adjustments to the latter.

If fees not in pursuit of regular trade and business, it is not subject to sales or business tax.

The confirmations are usually immediate except when you submitted on the deadline date itself as others are submitting on the same date.

Yes. 2550M is necessary because 2550Q is the consolidated version. Hence, if you have errors in the monthly returns, you may correct it on the 2550Q.

References:

https://efps.bir.gov.ph/efps-war/EFPSWeb_war/help/help2550m2006.html

Tax Help in the Philippines Facebook page

Philippine Tax, Accounting, and Audit Forum Facebook page

Disclaimer: The information contained in this article is based on existing regulations and policies as of May 17, 2018. To the best of our knowledge, this information is factual and correct. However, should there be any discrepancy, always consult BIR for clarification.

Click here for information on 2550Q and here for 2551Q.

We answered questions for SLSP too.

Oojeema’s built-in 2550M automatically updates as you add sales and purchase transactions. This means if you’re filing through eFPS or eBIR, you no longer have to manually compute input and output VATs. Just click generate then you can key in the amounts on the eBIR and eFPS portals.