In this guide, we will be going through receiving payments for both Sales and Billing invoices and the differences in how payments are made for both.

Note: Make sure you have added the GL Account of your bank in your Chart of Accounts if you haven’t done so yet.

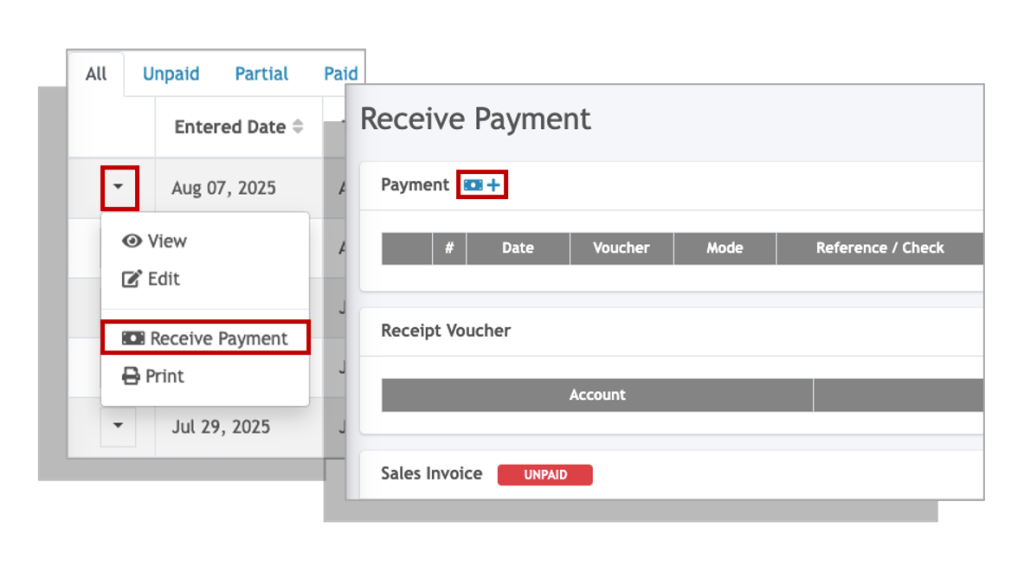

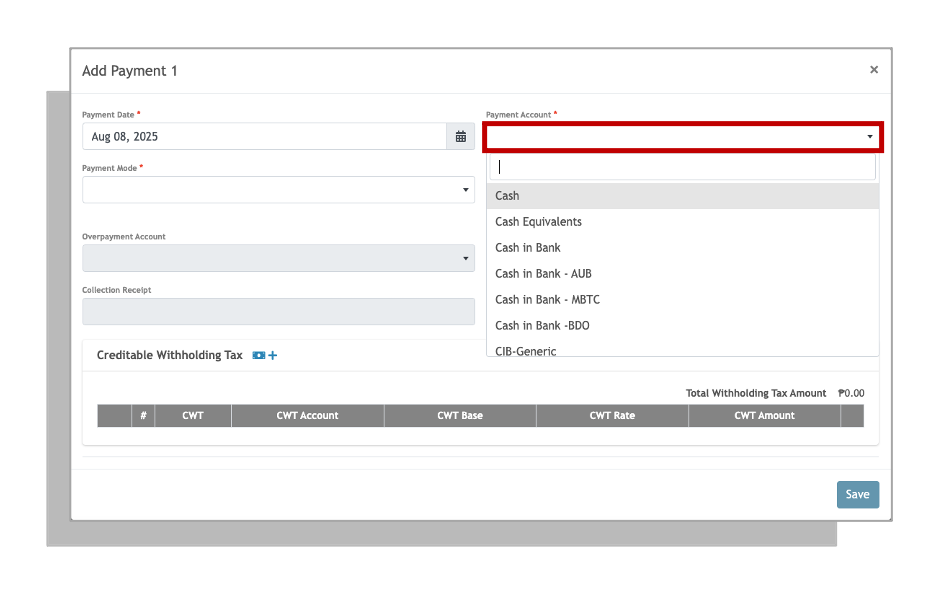

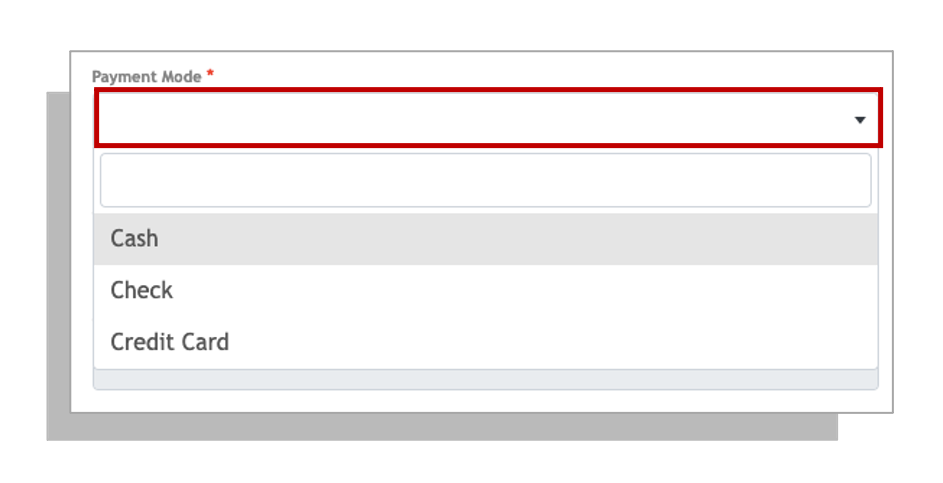

Payments per Invoice #

When receiving payments per invoice, go to the listing screen and click on the drop down icon beside the transaction you will be receiving a payment for.

Recording Creditable Withholding Tax (CWT) per Invoice #

A Creditable Withholding Tax (CWT) is tax withheld by a payer on behalf of a taxpayer, which can be credited against the taxpayer’s annual tax liability.

1. Click on the add withholding tax button.

2. Select an appropriate Alphanumeric Tax Code (ATC) from the Creditable Withholding Tax drop down field.

3. Enter the withholding tax base amount that will be the basis of the withholding tax computation. This is usually the net of VAT amount.

4. Click Confirm to apply.

5. You can add additional multiple withholding tax deductions (up to 5) by simply click on the add withholding tax button.

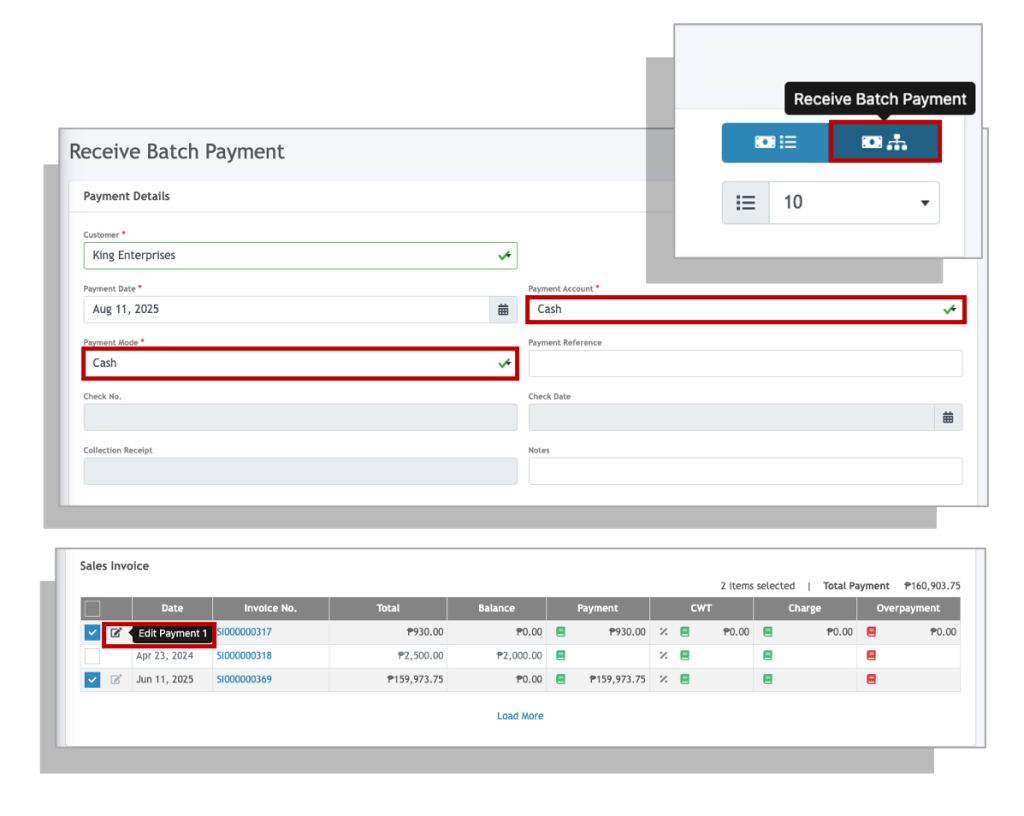

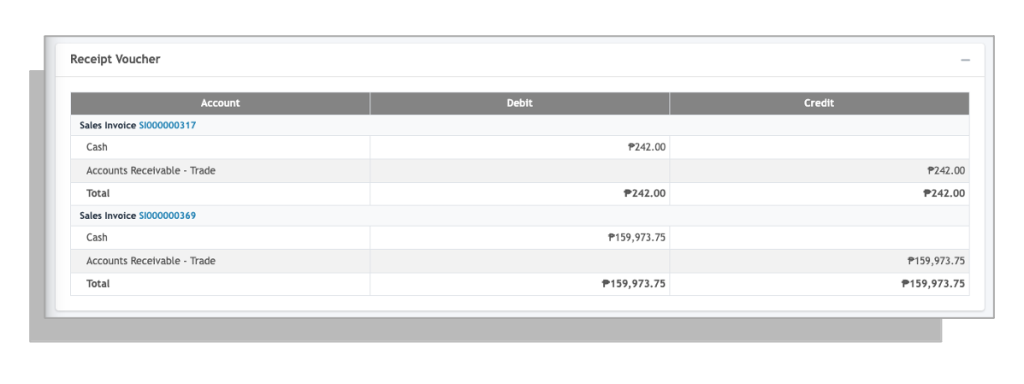

Receiving Batch Payment #

Aside from receiving payments for individual invoices, you may also receive payments from customers who wish to settle multiple invoices at once.

1. Click on the Receive Batch Payment icon located at the upper right hand-most corner.

2. Select the customer to show a list of invoices with outstanding payments

3. Select the invoices from the list and review amount to be paid per each invoice.

4. You may also apply partial payment to specific invoices by clicking the edit icon of the invoice then edit the payment amount.