Purchase returns handling allows you to record returns of paid items purchase from your vendors.

In this article, we’ll walk you through the step-by-step procedure to successfully process purchase returns, generate debit vouchers, and maintain a seamless record of your transactions.

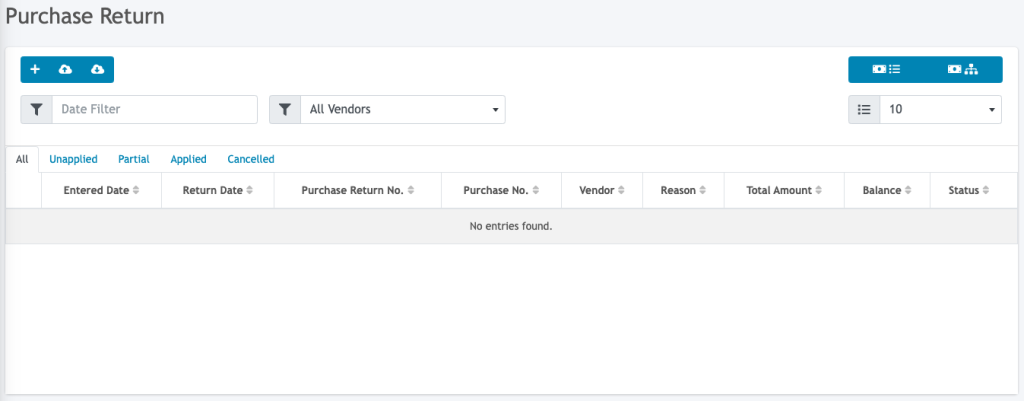

Step 1: Accessing the Purchase Return Module

- In the side panel, navigate Inventory and select the Purchase Return module.

- In the Purchase Return Listing screen, click on the plus “+” icon to initiate the creation of a new purchase return transaction.

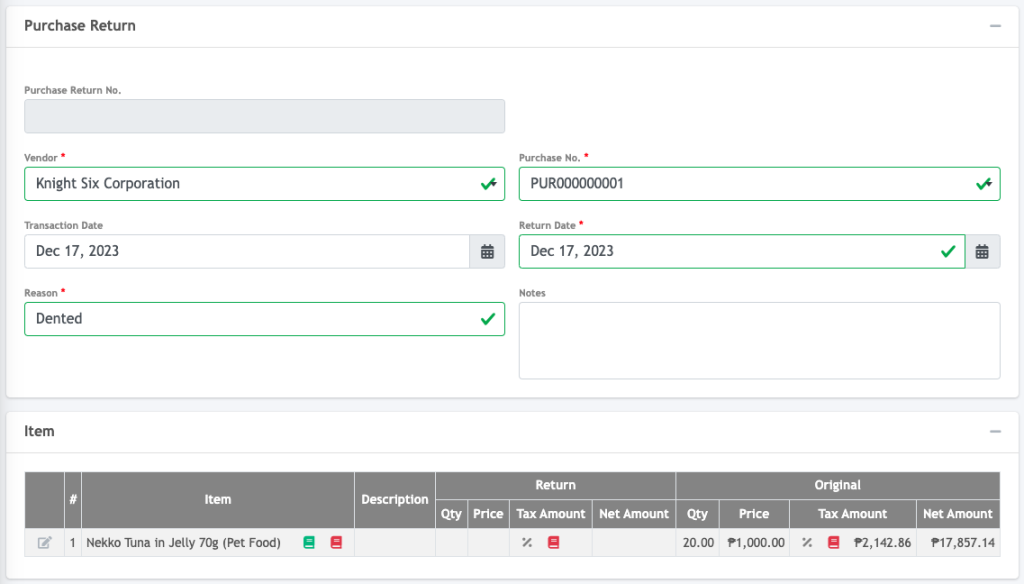

Step 2: Creating the Purchase Return Transaction

- In the purchase return screen, you’ll be prompted to select the vendor associated with the return.

- Choose the relevant vendor from the list.

- Select the specific purchase transaction for the return.

- Enter the reason for the return.

NOTE: Unpaid purchases will not show up in the purchase dropdown list for returns.

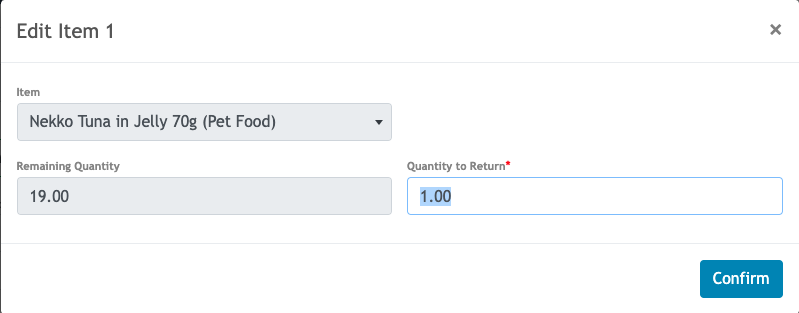

Step 3: Managing Items to Return

- Click on the edit icon to adjust the quantity the item to be returned.

- Enter the quantity to be returned.

- Click the “Confirm” button to proceed.

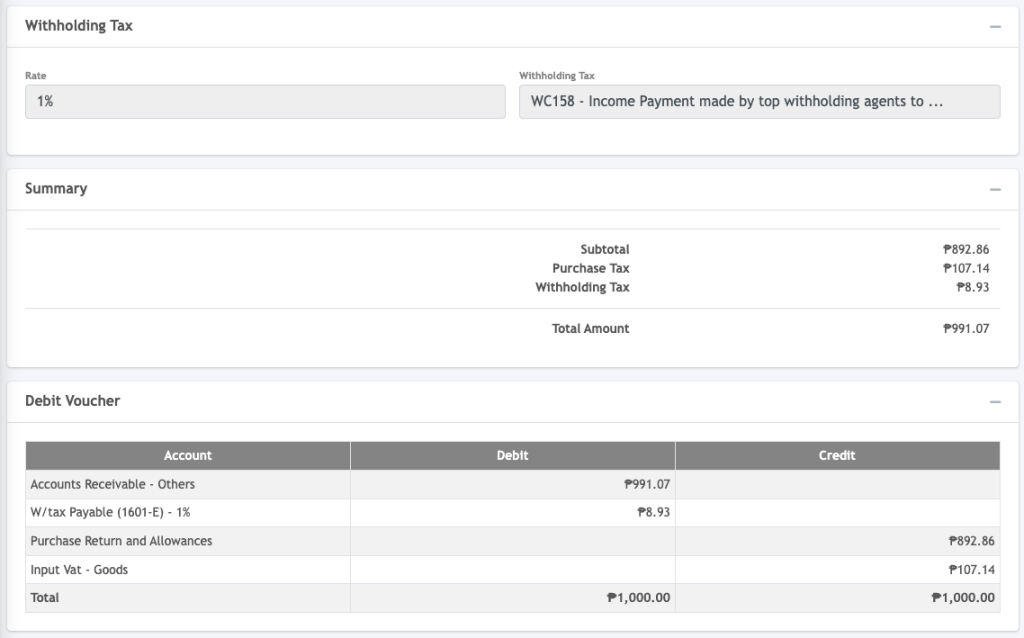

- This action finalizes the sales return transaction. A summary and the accounting entry of the returns for this transaction will be generated for you to review.

- If there was tax withheld in the purchase transaction, the withholding tax rate appropriate to the item/s to be returned is also automatically reversed.