Processing payroll in Oojeema can be done in 2 ways.

A Journal Voucher can be used not only for adjustments but also recording of transactions that is not currently supported by any modules in Oojeema. You can do journal voucher entries if your transaction does not need to capture any tax information such as VAT and Withholding Taxes (EWT & CWT)

Direct Journal Entry #

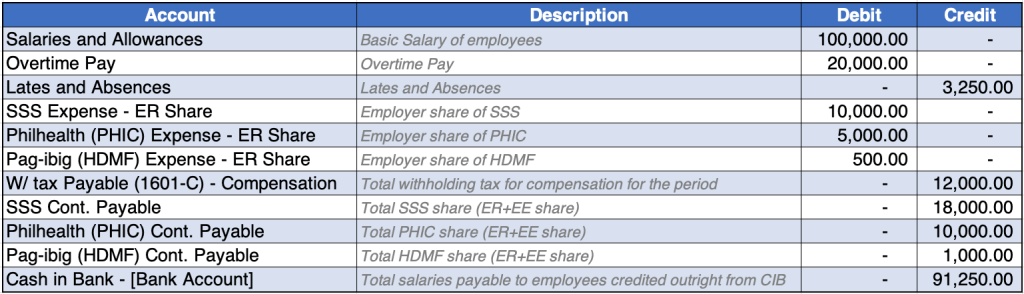

A direct journal voucher entry requiring only 1 journal voucher transaction to record all payroll related entries including salaries, allowances, other compensations, and deductions for contributions and withholding tax payable to the government.

The approach here is to do a direct credit from the Cash in Bank account.

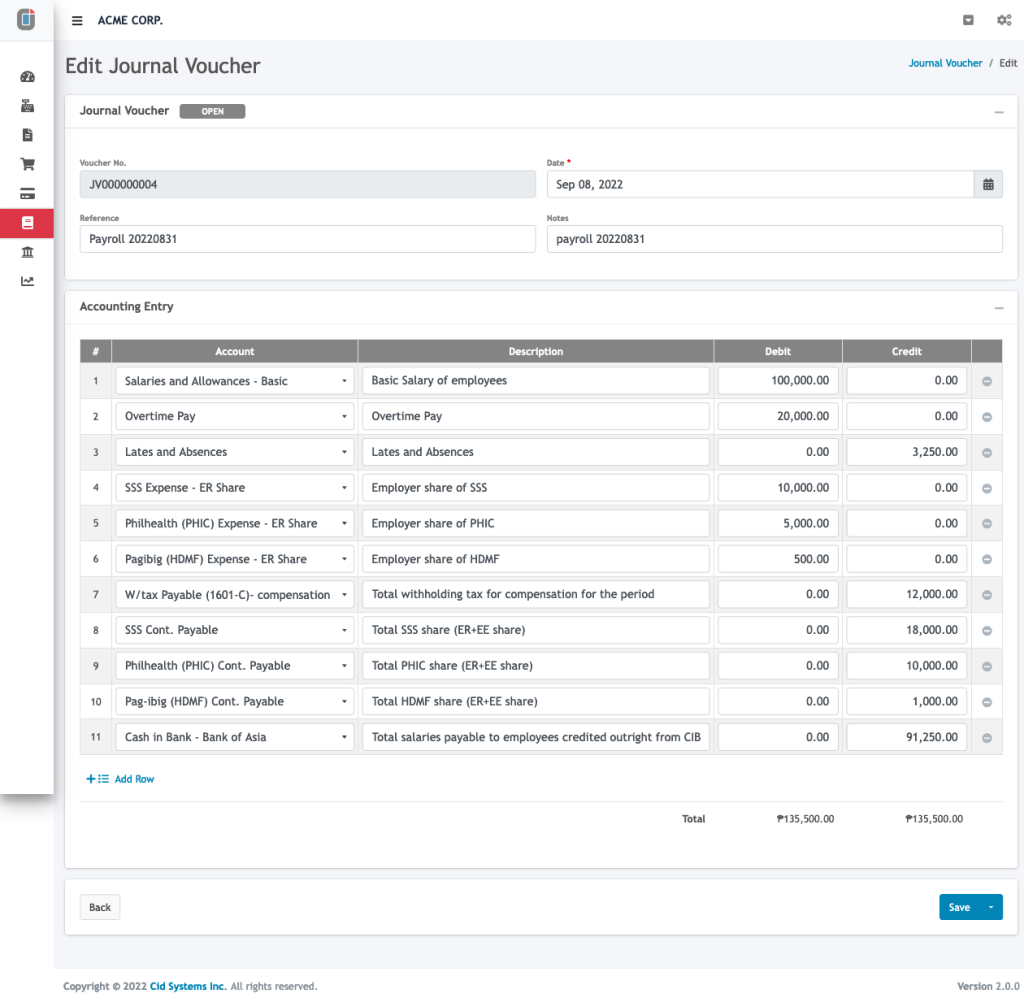

To do this in Oojeema follow these steps:

- From the Dashboard go to the side bar and select Journal Voucher

- Enter the appropriate Reference and Notes (optional)

Payroll Using Expense Module #

If you wish to record the disbursement of the Salaries and Wages and other government payables via cash or check disbursement you can use this approach.

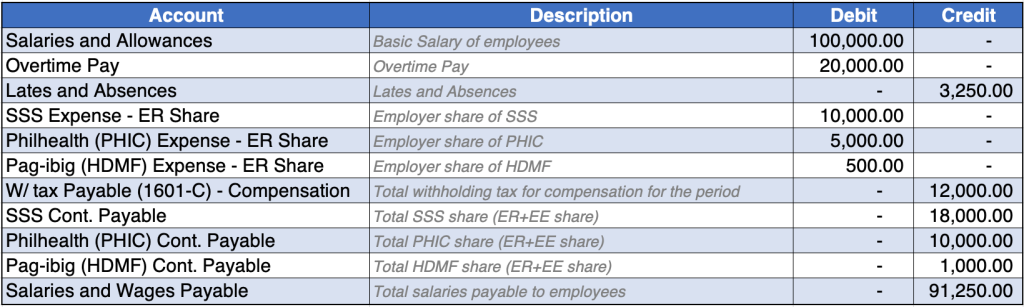

You would still need to do a Journal Voucher but with a small difference.

We credit the Salaries and Wages Payable account instead of the Cash in Bank account.

To do this in Oojeema follow these steps:

- From the Dashboard go to the side bar and select Journal Voucher

- Enter the appropriate Reference and Notes (optional)

- After creating the Journal Voucher, click save

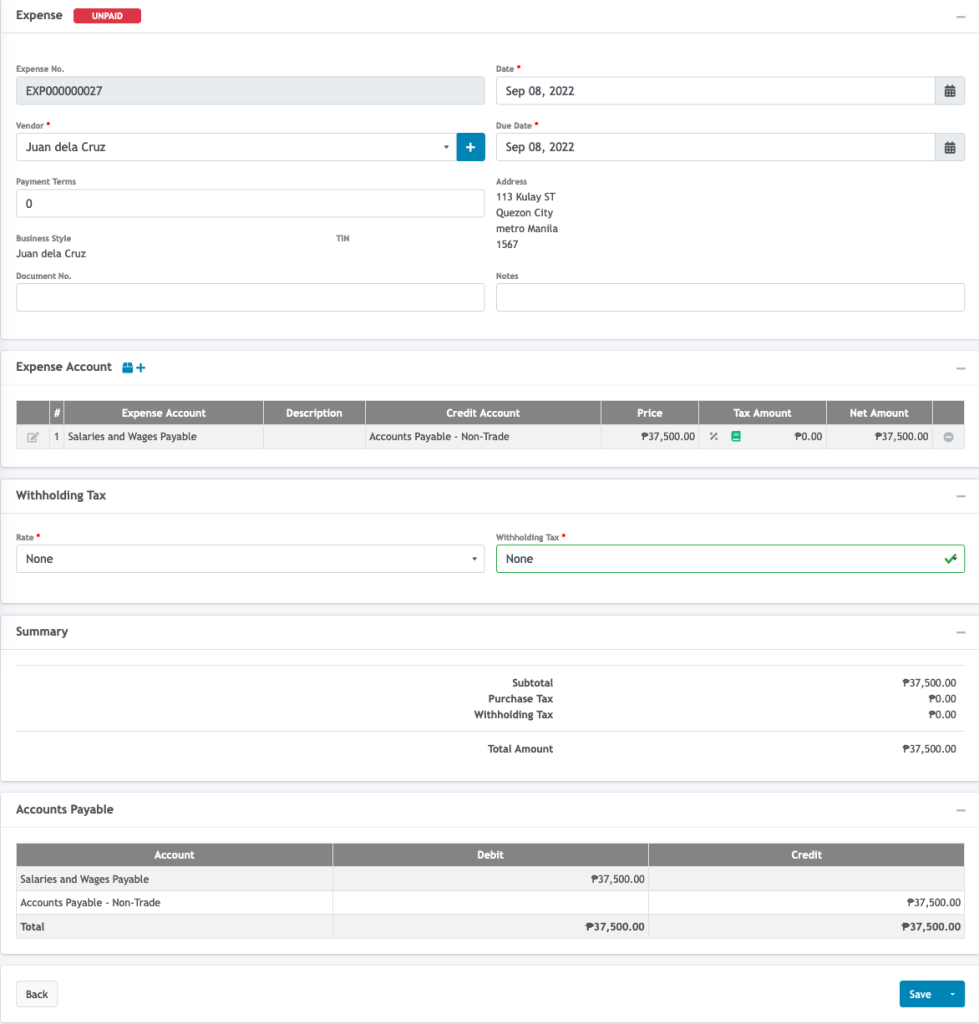

- Go to the side bar and select Expense

- Create an Expense transaction with the Employee as a Vendor. (adding a vendor)

To issue a payment for this expense refer to Issuing Payments

Repeat the steps for other employees and for the appropriate government agencies (BIR, Pagibig – HDMF, and Philhealth – PHIC).