Transactions for either Expenses or Revenues usually requires recording one rate of withholding tax and its corresponding Alphanumeric Tax Code (ATC). For transactions such as property rentals where there are Common Use Service Area (CUSA) charges, the withholding tax for rental fee and the CUSA are of different rates. The following sections will guide you in how to handle such transactions in Oojeema.

For this scenario, we will be using rental expense and rental revenue as an example.

Expense with Multiple Withholding Tax Rates #

Recording Rent Expenses #

1. Select Expense from the side bar.

2. Add an Expense and select a Vendor.

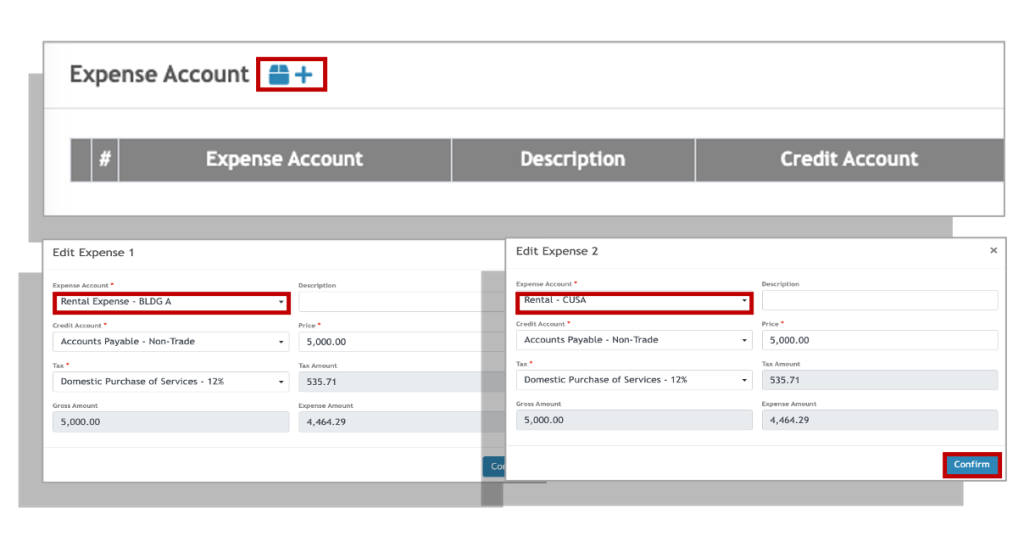

3. Click the expense account add icon then select the Rental expense. Enter the price and select the appropriate tax.

4. Click again the add icon then select the Rental – CUSA expense account. Enter the price and select the appropriate tax.

5. Click Confirm.

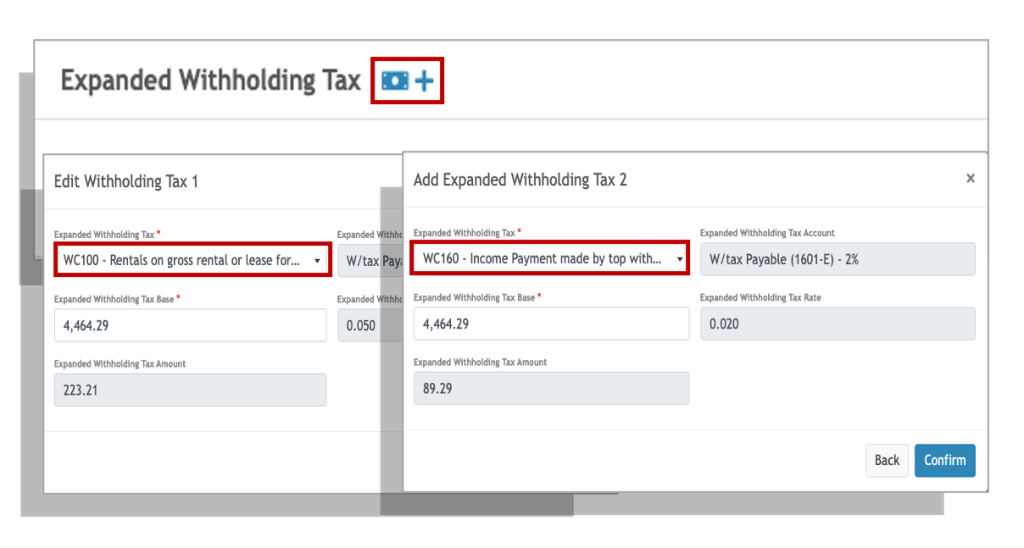

6. Click the Expanded Withholding Tax add icon then select the appropriate withholding tax rate. For Rental expense, select 5% and the appropriate ATC (WC100 for corporations or WI100 for Individuals).

7. Click again the add icon then select the appropriate withholding tax rate. For Rental – CUSA, select 2% and the appropriate ATC (WC160 for corporations or WI160 for Individuals)

8. Click Confirm.

Up to this point you would have recorded the rental expense and the CUSA. If your lessor billed you other charges like water, lights, security, and etc. repeat the steps in recording the expense

Issuing Payment for the Rental Expenses #

To pay for the above rental expenses, use the Issue Batch Payment option.

- From the Expense listing screen, click on the Issue Batch Payment icon.

- Select the Vendor (your lessor). You will be shown the list of expenses due.

- Select the Payment Account where you will be issuing the payment from.

- Select a Payment Mode.

- Select the Expenses you wish to settle.

- Click Save.

1. Select Billing Invoice from the side bar.

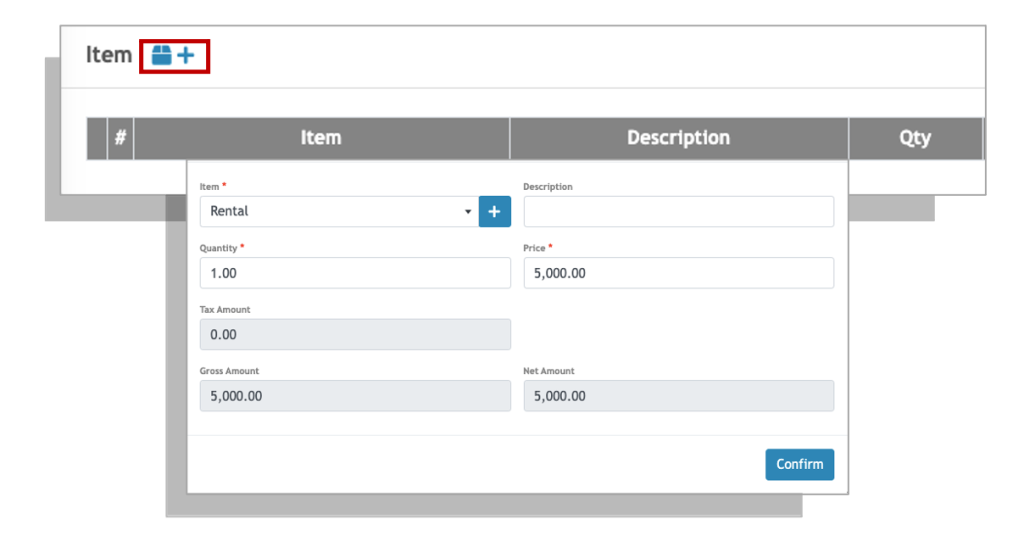

2. Add an Expense and select a Customer.

3. Click the expense account add icon then Select an appropriate service item (i.e. Rental). Enter the price and select the appropriate tax.

4. Click again the add icon if you need to charge other items such as rental-CUSA, pest control services, and etc. Enter the price and select the appropriate tax.

5. Click Confirm.

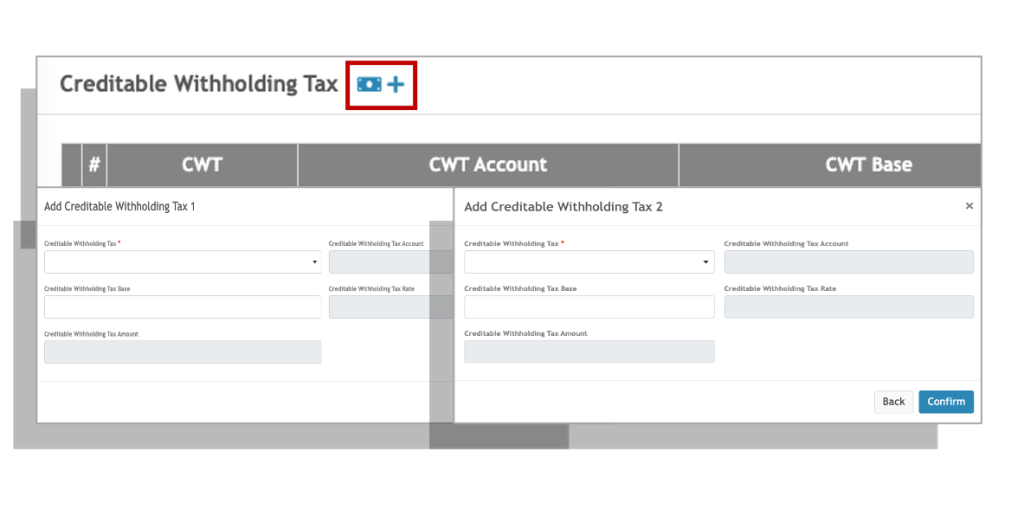

6. Click the Creditable Withholding Tax add icon then select the appropriate withholding tax rate. For Rental expense, select 5% and the appropriate ATC (WC100 for corporations or WI100 for Individuals).

7. Click again the add icon then select the appropriate withholding tax rate. For Rental – CUSA, select 2% and the appropriate ATC (WC160 for corporations or WI160 for Individuals)

8. Click Confirm.

Receiving Payment for Rental Revenues #

To receive payments of rental revenues for service items with different creditable withholding tax (CWT) rates and ATC, we would need to receive partial payments. Each partial payment corresponds to the service items with the same CWT AND ATC

- From the Billing invoice listing screen, click on the drop down icon beside the Billing Invoice you intend to settle.

- Select Receive Payment

- Click on the add payment icon.

- Select the payment account and payment mode.

- Enter the payment amount

- Select the appropriate creditable withholding tax ATC

- Enter the CWT base amount. This is the amount that is net of VAT (without VAT) to apply the CWT. ( if haven’t added CWT yet)

- Click save

- Repeat steps 1-8 for the other service items in the billing invoice.