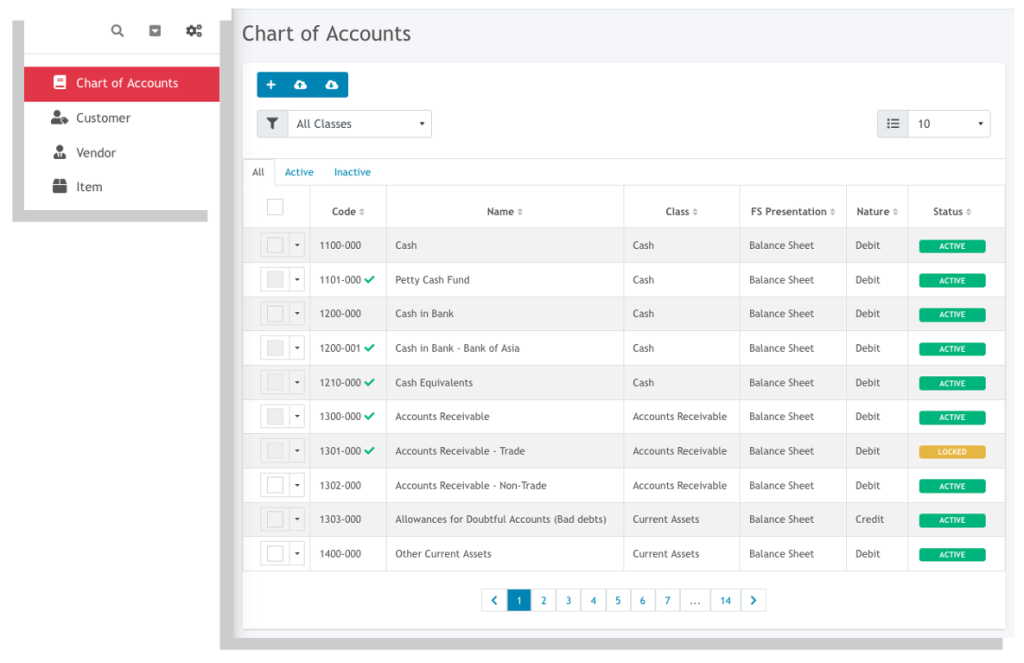

Your Oojeema accounts comes with a pre-defined chart of account that you can use straight-away and you can add GL accounts for your bank as well as other accounts that is specific for your business.

It also comes with locked accounts that Oojeema uses to automate some transactions so you can focus on recording your transactions. Some examples of the locked accounts are GL accounts used for the tax forms and reports. We also included some accounts that would help you in setting up your items and other transactions.

Adding an Account #

- Go to Settings, then Chart of Accounts

- The Chart of Account listing page with load.

- Click on the plus (+) icon to add an account.

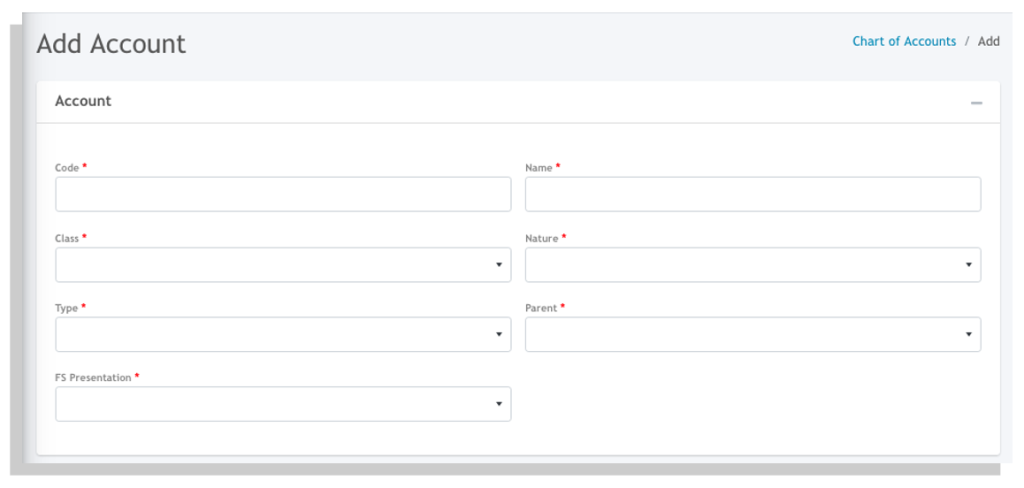

4. In the Add Account form, you would need to fill up all the fields to add an account.

- Code – assign a unique code to the GL account you want to add.

- Name – assign a name for this GL account.

- Class – select from the list of account classes.

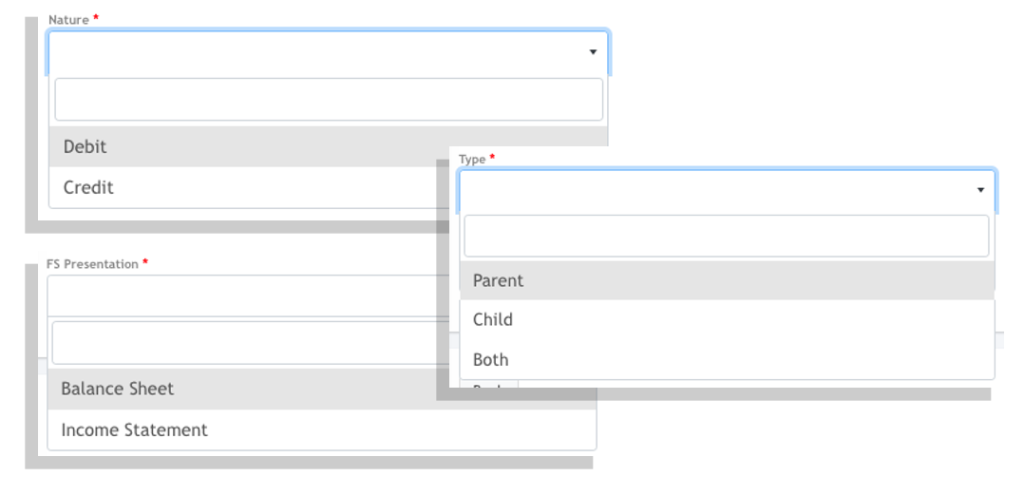

- Nature – select whether the GL account you are adding is normally Debit or Credit.

- FS Presentation – select whether is is a Balance Sheet or an Income Statement account

- Type – Parent, Child, or Both.

The parent and child is basically used to structure the chart of accounts here in Oojeema.

When setting up a child account you would need to specify which parent this account belongs to

Example

Accounts Payable – Parent

Accounts Payable (Trade) – Child

Here’s another example:

Accounts Receivable – Parent

Accounts Receivable (Trade) – Both

Accounts Receivable (Trade – goods) – Child

Accounts Receivable (Trade – services) – Child

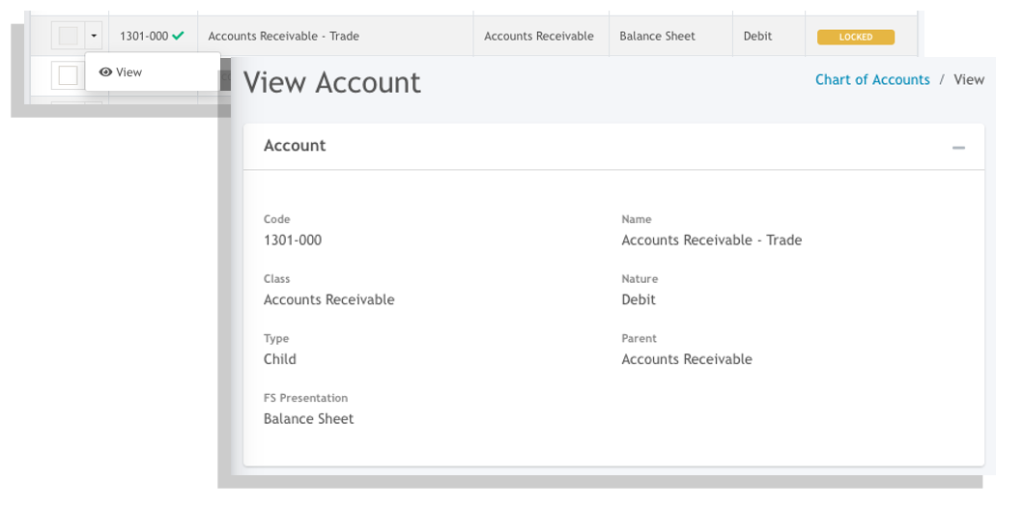

Locked Accounts #

Locked accounts cannot be edited to prevent issues with the built-in automation. You can however view the details of the accounts.

Setting up of Chart of Accounts #

- Ensure that added or customized accounts comply with standards and GAAP, aligning with the parent account (Account Type) to prevent financial misstatements.

- To accurately reflect the financial position, it is essential to create separate accounts for both the current and non-current portions, as certain items in the financial statements may have components that are classified as current or non-current based on their due dates or expected realization.

- Common mistakes in setting up the chart of accounts (COA) include misclassifying accounts, failing to update it regularly, and not maintaining a clear structure. These errors can lead to inaccurate financial reports and long-term management challenges. To avoid this, regularly review and update the COA to align with business changes, customize it to the organization’s needs, and ensure accounting staff understand its structure and use for accurate financial management.

Recommended COA Structure: