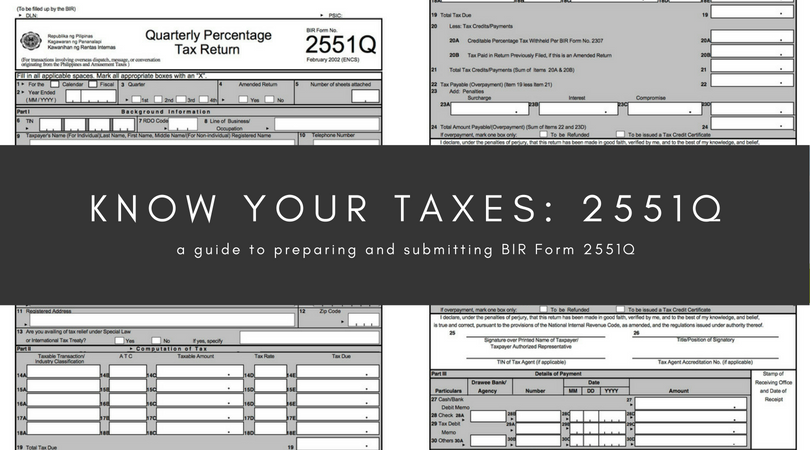

BIR Form 2551Q is also known as the Quarterly Percentage Tax Return form.

Non-VAT registered individuals or non-individuals “who sell goods, properties or services, whose annual gross sales and/or receipts do not exceed three million pesos (Php3,000,000.00) and are exempt from value-added tax (VAT) under Section 109 (BB) of the National Internal Revenue Code, as amended by Republic Act (RA) No. 10963” and others.

Form 2551Q is due within 25 days after the close of the taxable quarter.

Fill out all the necessary fields on the form, making sure all values and data are correct. For fields with options, place an X mark right next to the applicable choice.

To make form preparation less complicated, you may use Oojeema’s built-in 2551Q. Oojeema’s built-in 2551Q automatically updates as you add sales and purchase transactions. This means if you’re filing through eFPS or eBIR, you no longer have to manually compute input and output VATs. Just click generate then you can key in the amounts on the eBIR and eFPS portals.

Proceed to the RDO for penalties computation then file online as usual.

Yes. These two are different reports. 2551Q is for the percentage tax; 1701Q is for the income tax.

Don’t put/choose ATC.

Yes. But you don’t have to pay for anything. Zero sales mean zero tax.

Yes, if percentage taxes are withheld.

You may print the tax return receipt confirmation and pay. No need to wait.

According to BIR

“If manual filers also paid the percentage tax due for the third month using

BIR Form No. 2551M, taxpayer still needs to file the quarterly percentage

tax return (BIR Form No. 2551Q) and indicate in the return the total gross

sales/receipts for the quarter and the total payments made for the three

(3) month/s in Item No. 17-Other Credit/Payment made of the newly revised

BIR Form No. 2551Q.”

References:

Tax Help in the Philippines Facebook page

Philippine Tax, Accounting, and Audit Forum Facebook page

Disclaimer: The information contained in this article is based on existing regulations and policies as of January 14, 2019. To the best of our knowledge, this information is factual and correct. However, should there be any discrepancy, always consult BIR for clarification.

Click here for information on 2550M, here for 2550Q, and here for SLSP.

Make tax forms filing simpler.