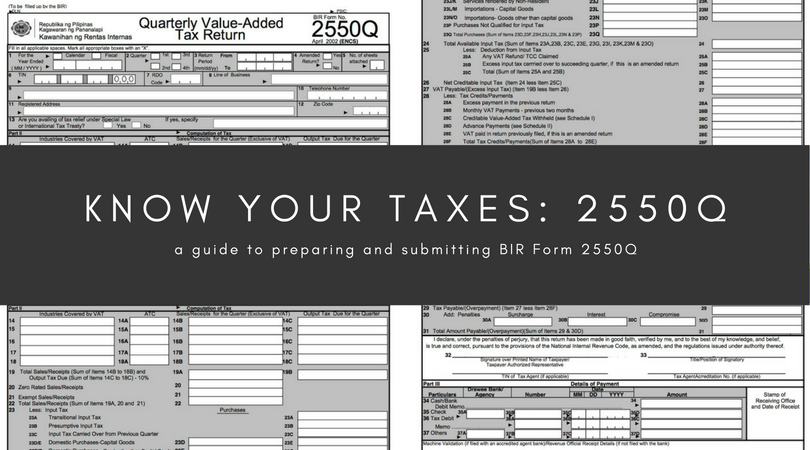

BIR Form 2550Q is also known as the Quarterly Value-Added Tax Return form. It’s like the Form 2550M only this is filed quarterly.

If you’re a VAT-registered business or a business required to register as a VAT payer, you should file 2550Q if your business’ actual gross sales or receipts exceed three million (3,000,000) pesos.

Also, if your business is in the importing of goods, you need to file 2550Q.

Form 2550Q is due within 25 days after the close of the taxable quarter.

Fill out all the necessary fields on the form, making sure all values and data are correct. For fields with options, place an X mark right next to the applicable choice.

To make form preparation less complicated, you may use Oojeema’s built-in 2550Q. Oojeema’s built-in 2550Q automatically updates as you add sales and purchase transactions. This means if you’re filing through eFPS or eBIR, you no longer have to manually compute input and output VATs. Just click generate then you can key in the amounts on the eBIR and eFPS portals.

There’s no limit to the number of amendments, but note that it may trigger investigations. Deadline-wise, you may submit it as long as there’s no notice for audit from the BIR for the period you are amending.

Yes. The quarterly reports are what’s final. This includes the quarterly RELIEF.

No. eSubmission is enough.

No. Just attach the advisory (e.g. see image) if it becomes an open case.

–BIR Form 2306. SLSP includes all sales be it exempt, vatable or, zero-rated.

Yes, as long as you keep a centralized copy of all your email confirmation

No. 2550Q should suffice.

You need to refile using 2550Q indicating the amount paid in the misfiled 2550M. If it’s beyond the deadline, you may be charged for late filing.

It depends on the sales. The amount is accelerated. Go to your RDO for the assessment.

It shouldn’t. But look for memorandums to avoid being penalized.

It should be received within the day; otherwise, you may delete the RDO copy and save the 2550Q you made. Refile it. Note that this is only applicable if it’s not yet past the deadline.

If you still haven’t received the confirmation after doing the procedure above, maybe the system traffic is heavy.

Resend the correct form.

The extension is only for 2550M although the SLSP may be submitted until the 30th of the month following the close of the taxable quarter.

References:

Tax Help in the Philippines Facebook page

Philippine Tax, Accounting, and Audit Forum Facebook page

Disclaimer: The information contained in this article is based on existing regulations and policies as of January 10, 2019. To the best of our knowledge, this information is factual and correct. However, should there be any discrepancy, always consult BIR for clarification.

Click here for information on 2550M, here for 2551Q, and here for SLSP.

Make tax forms filing simpler.