In this guide, we will be going through the different ways to issuing payments for both Purchase and Expense invoices.

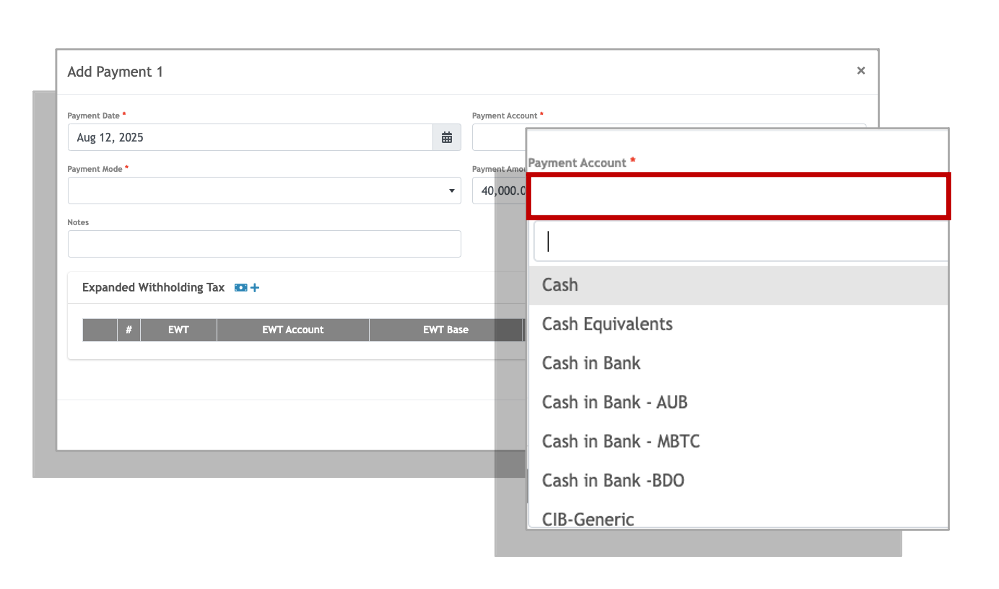

Note: Make sure you have added the GL Account of your bank in your Chart of Accounts if you haven’t done so yet.

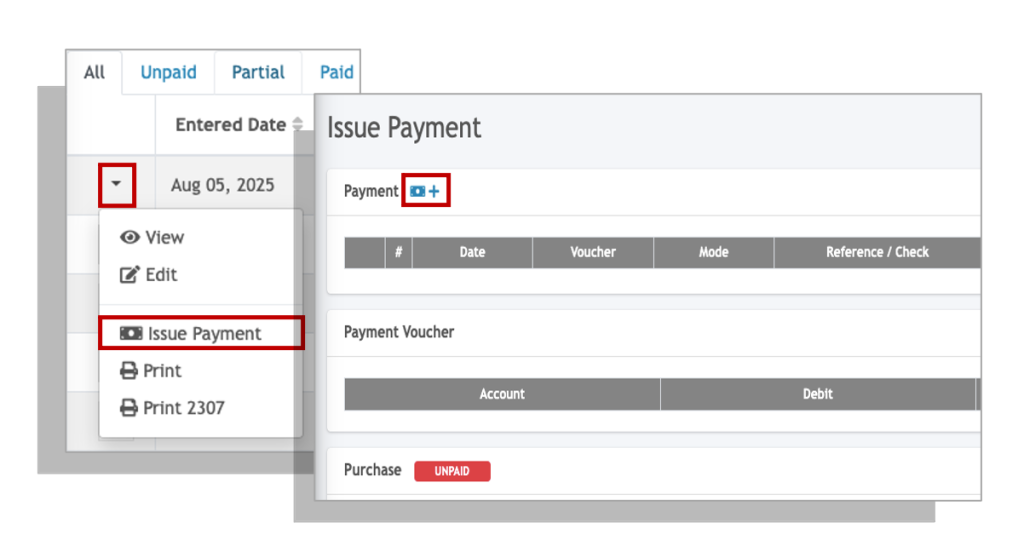

Issuing Payments per Invoice #

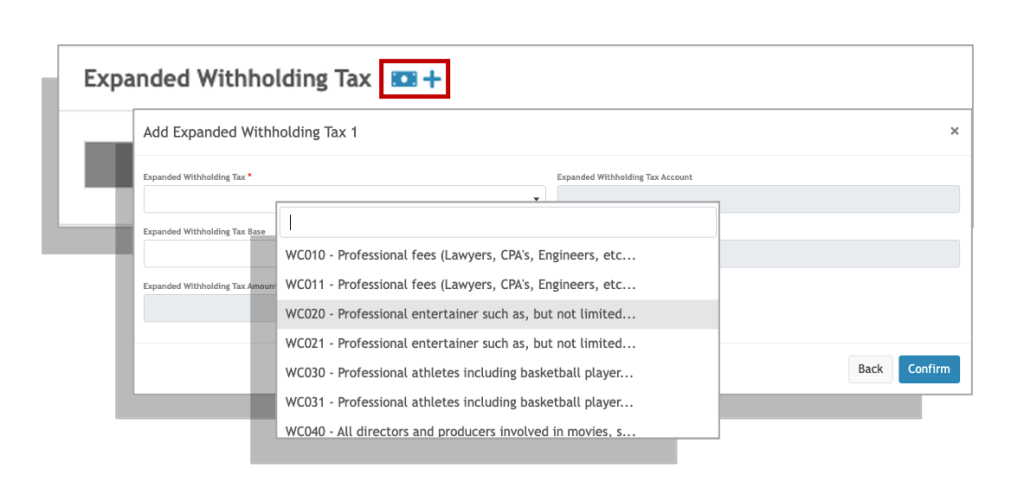

Recording Expanded Withholding Tax (CWT) #

1. Click on the add withholding tax button.

2. Select an appropriate Alphanumeric Tax Code (ATC) from the Expanded Withholding Tax drop down field.

3. Enter the withholding tax base amount that will be the basis of the withholding tax computation. This is usually the net of VAT amount.

4. Click Confirm to apply.

5. You can add additional multiple withholding tax deductions (up to 5) by simply click on the add withholding tax button.

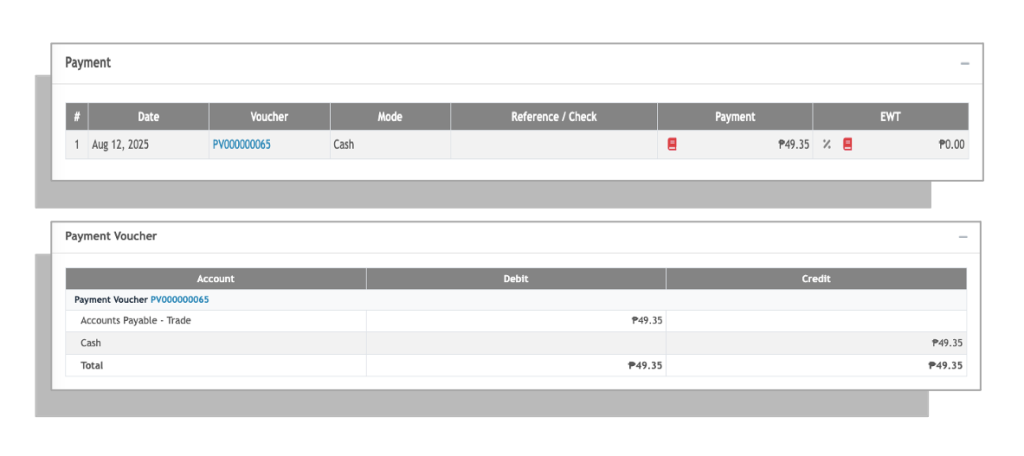

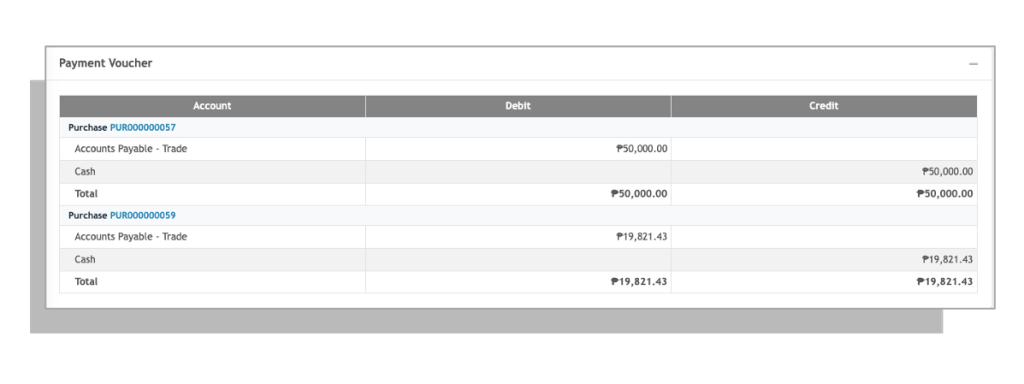

After completing the details of the payment. You may review the summary of the payments and the accounting entries for the receipt vouchers.

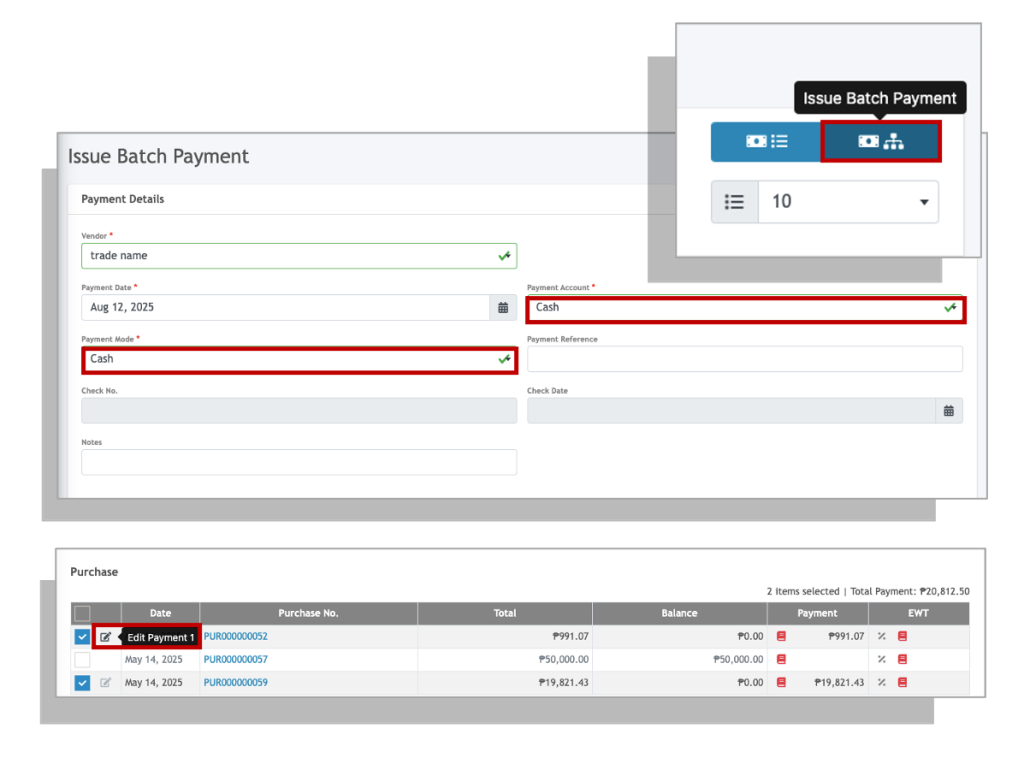

Issuing Batch Payment #

Aside from issuing payments for individual invoices, you may also issue payments to vendors where you wish to settle multiple purchases or expenses for.