Getting Started with Importing Expenses #

Before importing expenses, make sure you have already maintained your expense and credit accounts in your chart of accounts.

The following fields are the required fields to successfully import your file:

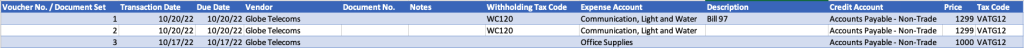

- Voucher No./Document Set – In the context of an expense transaction, one expense transaction is considered 1 voucher or a document set. If you have more than one expenses in the transaction, the document set groups lets the system know that the expenses belong to the same transaction

- Transaction date – This should be in the YYYY-MM-DD format. (please refer to your spreadsheet program documentation on how to format this)

- Due Date – This is the due date of the transaction

- Vendor – The vendor name (NOT CODE), that is maintained in your vendor maintenance data.

- Expense Account – This is the General Ledger account in your chart of accounts where you want to book the expense to.

- Credit Account – Select which Accounts Payable account where you want to credit the expense to.

- Price – Price of the expense item.

- Tax Code – The following are the acceptable code for importing sales invoices. Each line item may have its own tax code.

- IGOTCP – Importation of Goods Other Than Capital Goods

- VATG12 – Domestic Purchase of Goods Other Than Capital Goods

- VATG12E1M – Purchase of Capital Goods Exceeding 1M

- VATG12NE1M – Purchase of Capital Goods Not Exceeding 1M

- VATGNQITAX – Purchase Not Qualified for Input Tax

- VATS12 – Domestic Purchase of Services

- VATS12NR – Services Rendered by Non-Residents

- VATZRP – Services Rendered by Non-Residents

- None – for transactions with no tax or leave the field/cell blank if there is no tax for the transaction

The following are optional fields

- Document No. – This is an alpha-numeric field that you can enter in reference to your purchase.

- Notes – Add additional alpha-numeric notes to describe this purchase

- Description – Enter the description of the item. If you enter a different description than the one maintained in your item maintenance, the system will pick up the one you entered. Otherwise, if you leave this blank, the system will NOT default to the maintained description of the item.

- Withholding Tax Code – If you are a withholding agent and needs to withhold tax for your purchases, enter the Alphanumeric Tax Code (ATC) here. For the list of ATC, refer to the Withholding Tax maintenance by going to Settings – Withholding Tax.

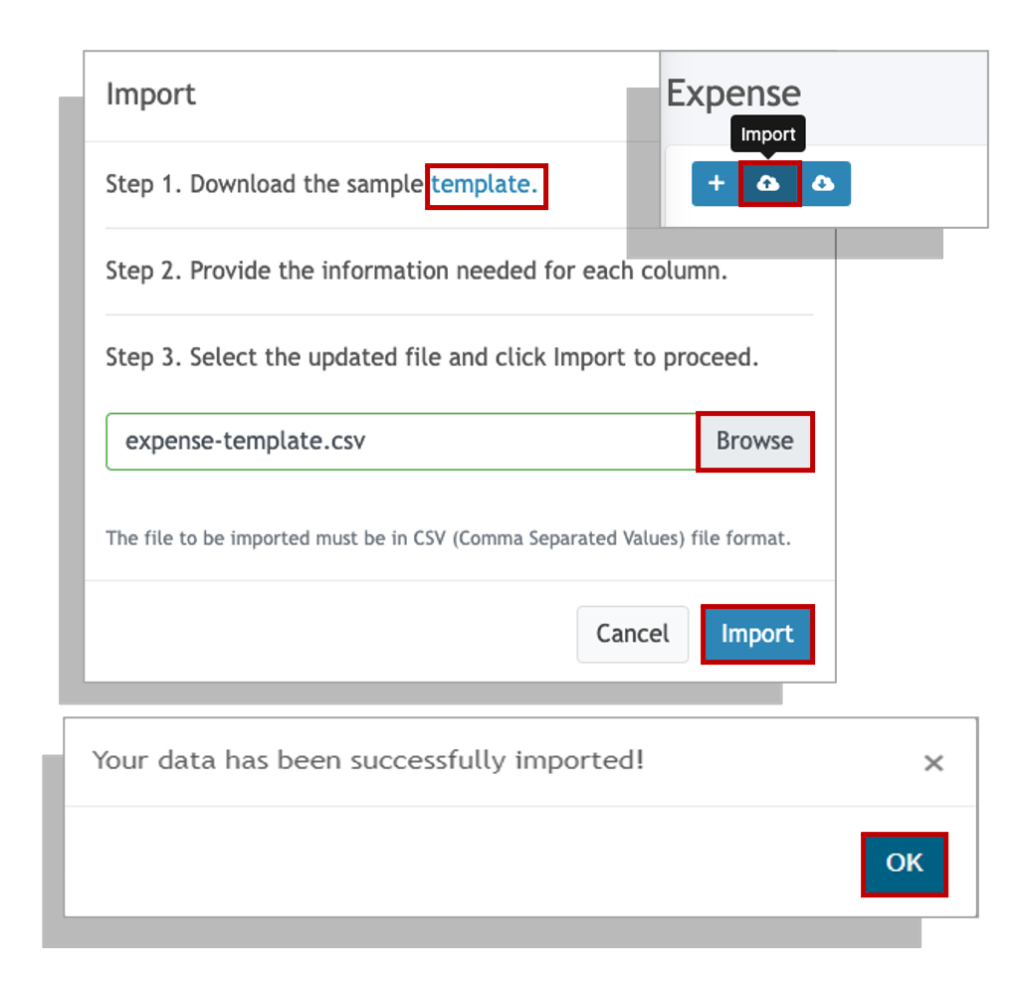

Steps in Importing Expense Transactions #

1. From the Dashboard, click on the side bar and select Expense

2. Click on the import icon located at the upper left hand-most corner.

3. Download the import template

4. Fill-up the import template following the guide in the section above.

5. Attach the template by click on the browse button to look for the filled up template.

If you encounter any errors you do not understand after uploading the template. Take a screenshot of the errors and email it to support at oojeema dot com.