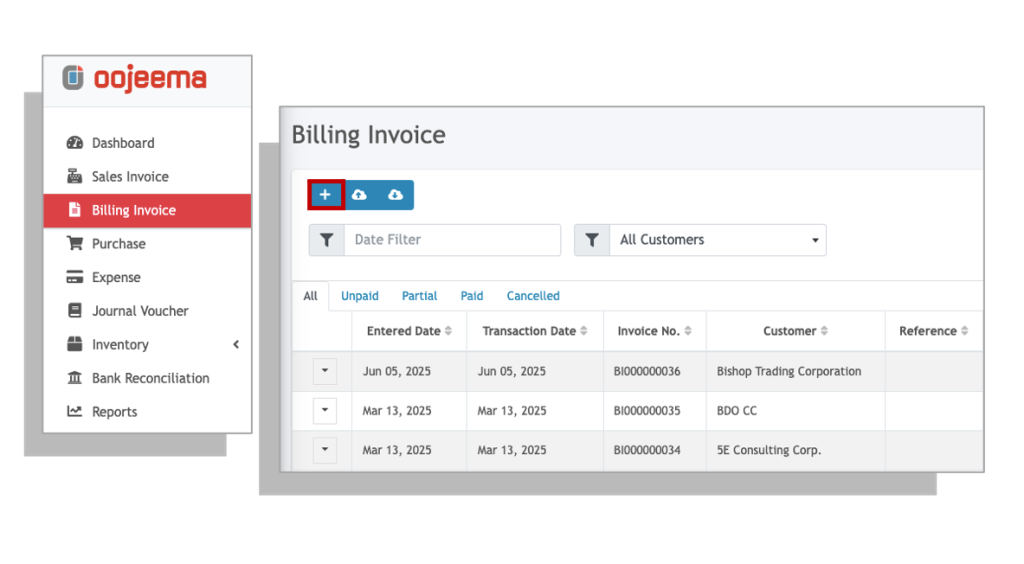

Billing invoices in Oojeema are used to record sales of services to customers.

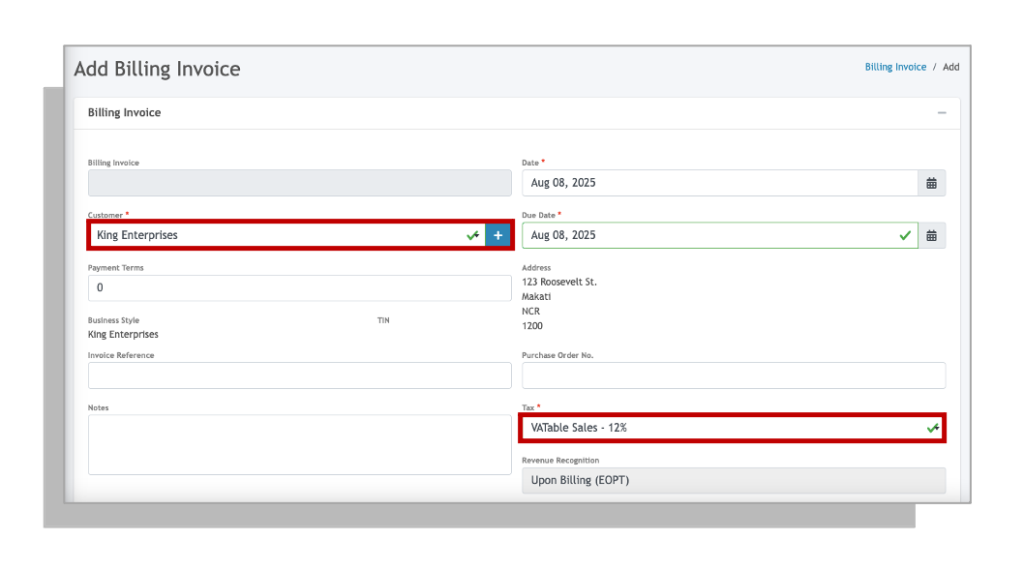

Select a Customer #

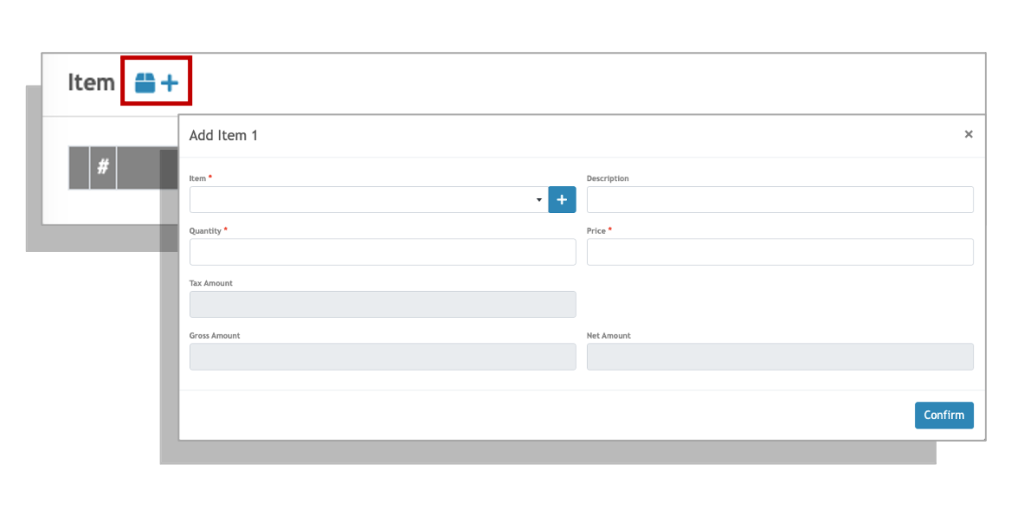

Adding an Item #

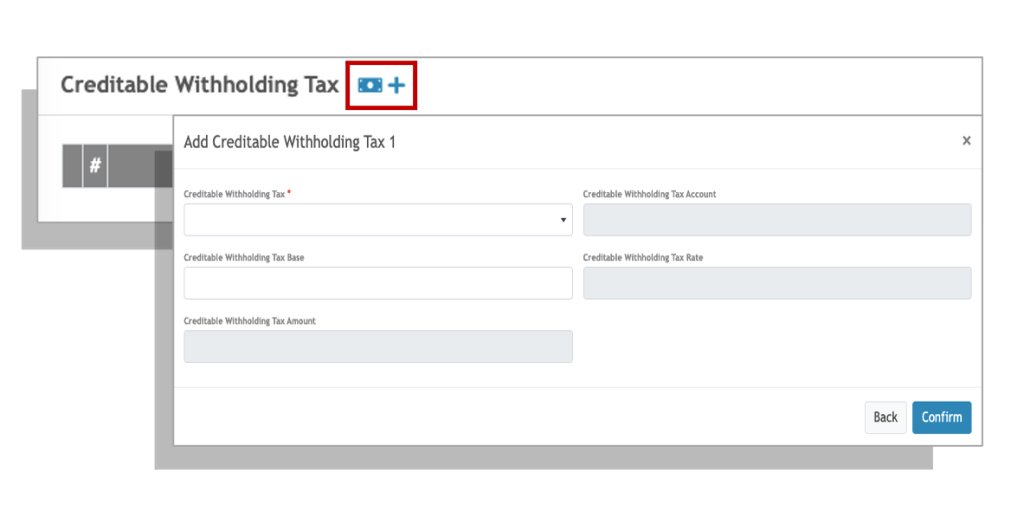

Applying Creditable Withholding Tax (CWT) #

1. Click on the add withholding tax button.

2. Select an appropriate Alphanumeric Tax Code (ATC) from the Creditable Withholding Tax drop down field.

3. Enter the withholding tax base amount that will be the basis of the withholding tax computation. This is usually the net of VAT amount.

4. Click Confirm to apply.

5. You can add additional multiple withholding tax deductions (up to 5) by simply click on the add withholding tax button.

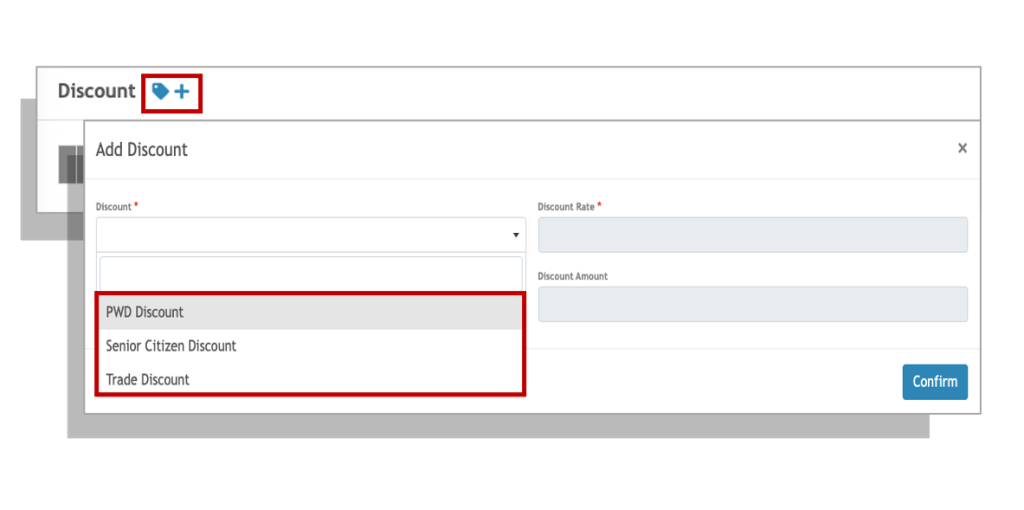

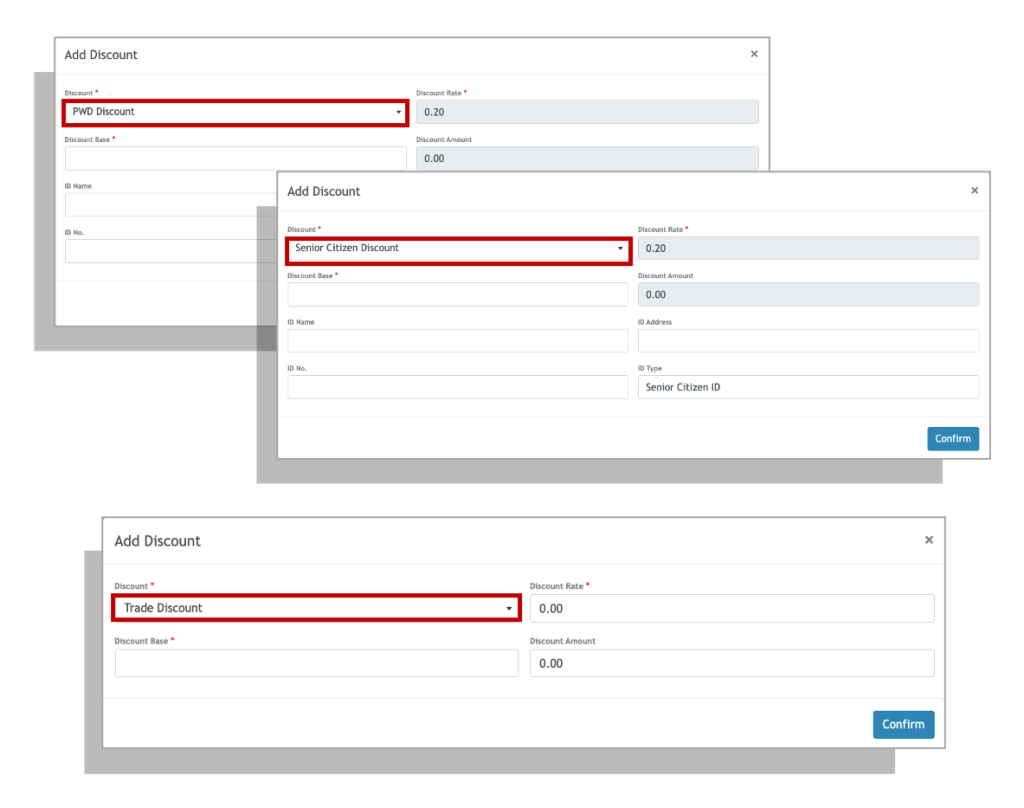

Applying a Discount #

PWD & SC Discounts

1. Enter the gross amount that you would like to apply the discount to, and Oojeema will automatically compute for the 20% discount.

2. Enter the identification details of the person availing the PWD/SC discount.

Trade Discount

Enter the gross amount and enter either the discount rate (in decimal) or the amount you want to apply.

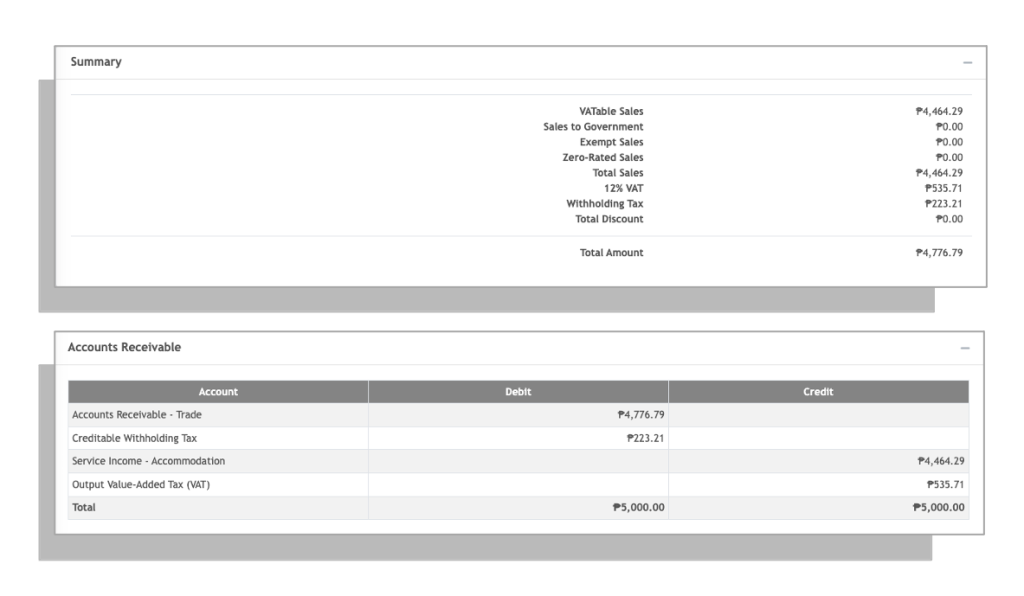

Summary #

You may review the summary of your transactions and also check the account entries of your transactions in the Accounts Receivable section.

Since income for billings or services are recognized upon settlement of invoice, Oojeema books the sales to a Sales Clearing account and reverses this upon payment from the customer.